Accounting, Auditing and Taxation (M.A.)

The consecutive Master's programme in Accounting, Auditing and Taxation (MAAT) has been successfully offered at the Bochum University of Applied Sciences since 2009: During the four-semester master's programme, you will receive a broad business education with a focus on national and international accounting, controlling, auditing and corporate taxation. You will also deepen your knowledge of general business administration, economics and business law.

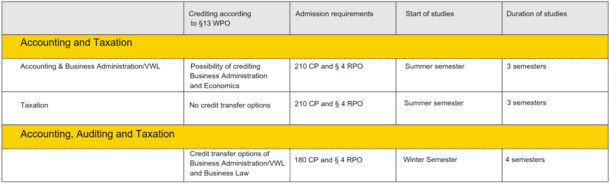

Perhaps you would even like to pursue a career as an auditor? With our Master's programme in Accounting, Auditing and Taxation, you have the opportunity to have the examination areas of Business Administration and Applied Business Administration credited towards the auditor's examination in accordance with Section 13b of the German Auditors' Code (WPO). This option must be approved by the Examination Office of the Chamber of Public Accountants for each new year of study. Bochum University of Applied Sciences is currently the only university in the Ruhr area to offer this programme.

Admission to the MAAT programme is possible in the winter semester. Upon successful completion of the programme, students are awarded the academic degree of Master of Arts (M.A.) by Bochum University of Applied Sciences.

*For documents such as exam regulations and module handbook, please visit the programme's german page.

However, the programme will not restrict you to the profession of accountant. The MAAT also offers you very good opportunities in the fields of accounting, taxation, finance and controlling in all sectors, where the excellent career prospects for graduates are well known.

The breadth of the curriculum will also enable you to enter fields such as treasury, public service (entry into the higher civil service), mergers and acquisitions, management consultancy, rating, investor relations, strategic planning and credit assessment.

In addition, successful completion of the MAAT qualifies you for subsequent doctoral study.

In addition to the general admission requirements according to § 4 RPO, admission to the Master's programme in "Accounting, Auditing and Taxation" requires a qualified degree (Bachelor's or Diplom) with an overall grade of at least 2.5 (up to 2.59) from a degree programme of at least 6 semesters (180 credit points) in "Business Administration/Economics" or "Economics" or a comparable degree programme from a state or state-recognised university.

In addition, proof is required of special previous education relevant to the programme (Section 49 (7) of the Higher Education Act of the State of North Rhine-Westphalia), which is provided by the successful completion of the following study modules or subjects in the Bachelor's or Diplom programme

1. cost and performance accounting and/or controlling or comparable courses totalling at least 4 ECTS,

2. corporate finance and/or investment accounting (investment and financing) or comparable courses totalling at least 4 ECTS credits,

3. management and organisation or equivalent courses of at least 4 ECTS credits,

4. accounting and/or financial statements or comparable courses of a total value of at least 4 ECTS credits

5. mathematics and/or statistics or comparable courses of a total of at least 4 ECTS credits

6. economics and economic policy or equivalent courses of a total value of at least 4 ECTS credits

7. tax law and/or corporate taxation or comparable courses of at least 4 ECTS credits; and

8. business law (BGB and commercial law) or comparable courses of at least 4 ECTS credits.

In cases of doubt, the Head of Programme, in consultation with the Examination Committee, will decide whether the admission requirements have been met.

Applicants with qualifications obtained abroad may be admitted on application, provided that proof of equivalence is provided.

Applicants who have not obtained their qualifications at a German-speaking institution must provide evidence of the German language skills required for the programme at level C 1 of the Common European Framework of Reference for Languages (CEFR). Further information for applicants with foreign qualifications can be found on the here.

The required overall grade is not an NC, but an admission requirement that must be met in order to participate in the application process.

This means that an application (overall grade below 2.59) will not be considered and cannot be included in the allocation process.

Note for prospective international students

International students please note the language skills required for this degree programme.

The degree programme has a modular structure. Each module usually concludes with a two-hour written examination at the end of the semester. In the Accounting and Special Areas of Law modules, the duration of the written examination is 4 hours. For a detailed overview of the individual modules, including examination types and the course of study, please refer to the module handbook.

The module phase is supplemented by an internship of at least six weeks. This allows you to put the knowledge you have learnt directly into practice and, for example, gather ideas for your subsequent Master's thesis. The colloquium concludes your training.

This degree programme is part of the Ruhr Master School (RMS). Choose from additional compulsory elective modules from the partner universities Dortmund University of Applied Sciences and Westphalian University of Applied Sciences, which will be recognised for your studies at Bochum University of Applied Sciences. Take advantage of the extended study options!

Accounting, Auditing and Taxation

Profile

Degree: M.A. Standard period of study: 4 semesters | Start: Winter semester | Admission-free

Contact us

Help with application and enrolment, financing questions or recognition of examination results

According to auditing firms and their clients, BO is one of Germany's best universities in the field of auditing: In a large-scale study conducted by manager magazin and WGMB (Wissenschaftliche Gesellschaft für Management und Beratung mbH), BO was ranked 4th among universities of applied sciences nationwide in 2020.