Accounting, Auditing and Taxation (M.A.)

The 3-semester Master of Arts in Accounting and Taxation (MAT) offers you in-depth professional training in the areas of national and international accounting, controlling and corporate taxation. Seminars are held in small groups to ensure that the knowledge and skills acquired during your first degree are optimally consolidated.

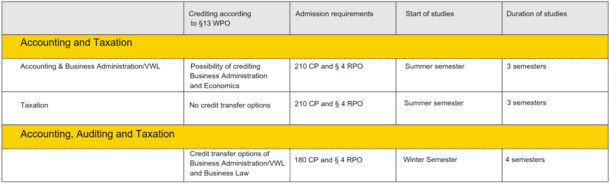

For new students starting in the summer semester 2022 (PO 2021), the MAT consists of a compulsory section and a compulsory elective section, in which you can choose between the specializations "Accounting & Business Administration/VWL" or "Taxation".

The compulsory section covers the following topics

- Accounting and Governance

- Financial Management

- Principles of Corporate Taxation

- Auditing

- Corporate Law

The compulsory electives in Accounting & Business Administration/VWL include:

- Investment and Finance

- Controlling

- macroeconomics

- Accounting

If you choose this compulsory elective, you will not only benefit from an excellent education, but also from the possibility of crediting the subject "Applied Business Administration, Economics" for the auditor exam according to § 13b WPO. What does this mean for you? If you decide to take the auditor exam, you can have the subject "Applied Business Administration, Economics" credited by the Chamber of Public Accountants and thus reduce the number of exams by two. This option is subject to the condition that the examination office of the Chamber of Public Accountants recognizes the Business Administration and Economics portion of the Master's program as equivalent to the CPA exam. We cannot guarantee this recognition in advance, but we would like to point out that the Bochum University of Applied Sciences has consistently received this recognition since 2009. Bochum University of Applied Sciences is currently the only university in the Ruhr area to offer this program.

In the Taxation elective, you will receive specialized training in the following areas

- In-depth study of corporate taxation

- Taxation of medium-sized companies

- Taxation of international operations and groups

- Special areas of law

You should consider this elective if you wish to specialize in taxation, for example, with a view to working in tax consulting or in the tax departments of companies.

Whatever you choose, you will always benefit from up-to-date, high-quality teaching. Our advisory board and the use of external lecturers ensure that there is always a link to practice.

You can start this master's program in the Department of Business and Management in the summer semester. Upon successful completion of the MAT program, you will be awarded the academic degree "Master of Arts" (M.A.) by the Bochum University of Applied Sciences.

*For documents such as exam regulations and module handbook, please visit the programme's german page.

The excellent career prospects for graduates in the fields of accounting, taxation, financing and controlling in all sectors are well known. There are also related fields such as management consultancy or strategic planning.

In addition, successful completion of the course qualifies graduates for a subsequent doctorate.

In addition to the general admission requirements according to § 4 RPO, admission to the Master's program "Accounting and Taxation" requires a qualified degree (Bachelor's or Diplom) with an overall grade of at least 2.5 (up to 2.59) from a course of study of at least 7 semesters (210 credit points) in "Business Administration/Economics" or "Economics" or a comparable course of study at a state or state-recognized university.

In addition, proof of a course-related special previous education (§ 49 Abs. 7 Hochschulgesetz NRW) is required, which can be provided by the successful completion of the following study modules or subjects in the Bachelor's or Diplom program

1. cost and performance accounting and/or controlling or comparable courses with a minimum of 4 ECTS,

2. corporate finance and/or investment accounting (investment and financing) or comparable courses of at least 4 ECTS credits,

3. management and organization or comparable courses of at least 4 ECTS credits,

4. accounting and/or financial statements or comparable courses of at least 4 ECTS credits

5. mathematics and/or statistics or comparable courses of at least 4 ECTS credits

6. economics and economic policy or comparable courses of at least 4 ECTS credits

7. tax law and/or corporate taxation or comparable courses worth at least 4 ECTS credits, and

8. Business Law (BGB and Commercial Law) or comparable courses worth at least 4 ECTS credits.

In cases of doubt, the head of the program, in consultation with the examination committee, will decide whether the admission requirements have been met.

Applicants with qualifications obtained abroad may be admitted on application, provided that they can provide proof of equivalence.

Applicants who have not obtained their admission requirements at a German-speaking institution must provide proof of German language proficiency at level C 1 of the Common European Framework of Reference for Languages (CEFR). Further information for applicants with foreign qualifications can be found here.

The overall grade required is not an NC, but an admission requirement that must be met in order to participate in the application process.

This means that an application with a GPA below 2.59 will not be considered and will not be included in the allocation process.

International students

As an international student applicant, please note the German language skills required for this degree program.

The first semester is where you set the course for your career. In addition to a required concentration, you will choose one of two required electives. In the second semester, you will focus on your chosen specialization before completing a six-week internship in the third semester. This allows you to put your knowledge into practice and, for example, gather ideas for your master's thesis. The colloquium concludes your studies.

According to auditing firms and their clients, BO is one of Germany's best universities in the field of auditing: In a large-scale study by manager magazin and WGMB (Wissenschaftliche Gesellschaft für Management und Beratung mbH), BO was ranked 4th among universities of applied sciences nationwide in 2020.

Accounting and Taxation

Profile

Degree: M.A. | Standard period of study: 3 semesters | Start of studies: Summer semester | Admission-free

Contact us

Help with applications and enrollment, financing questions or recognition of examination results

Contact for questions about the course content

This degree program is part of the Ruhr Master School (RMS). Choose from additional compulsory elective modules from the partner universities Dortmund University of Applied Sciences and Westphalian University of Applied Sciences, which will be recognized for your studies at Bochum University of Applied Sciences. Take advantage of the extended study options!